Should You Wait For Rates to Drop? SPOILER: It may cost you more to wait…

Published March 18, 2024.

Written by Stephanie Malki.

If you’ve been waiting for mortgage rates to drop before buying a home, I’ve got news for you… Experts say rates will come down—but not as much as many buyers hoped.

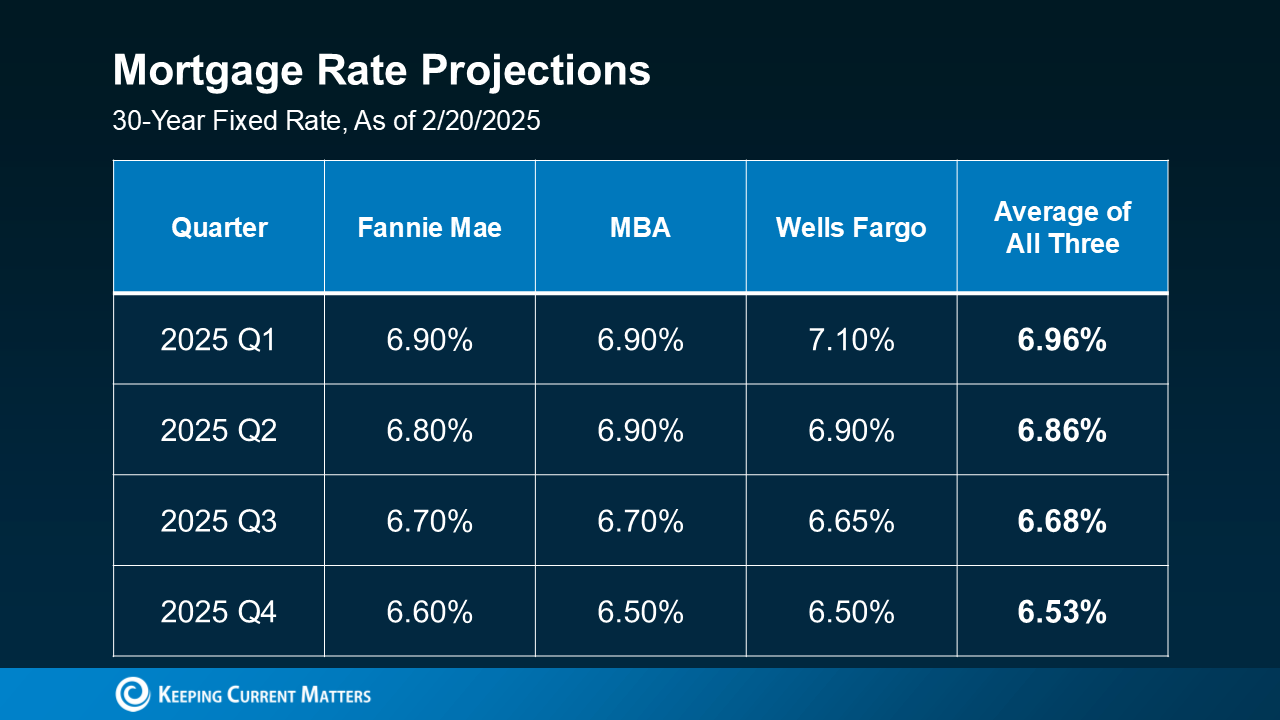

According to the latest projections, rates are expected to hover around 6.5% by the end of the year (see chart below). While that’s a dip, it’s far from the 5% rates some buyers were holding out for.

So, does this mean you should wait? Not necessarily.

💡 Smart buyers are getting into homes NOW using creative financing strategies that can help lower monthly payments today—without waiting for the perfect rate. Here are three ways you can do the same:

1. Mortgage Rate Buydowns

Sellers or lenders may offer temporary rate reductions to ease your payments for the first few years—giving you breathing room while waiting for rates to drop.

2. Adjustable-Rate Mortgages (ARMs)

These start with lower rates than traditional 30-year loans. Plus, today’s ARMs are way safer than the risky ones from the early 2000s.

3. Assumable Mortgages

Take over a seller’s existing low-rate mortgage (yes, that’s a thing!). Over 11 million homes qualify for this option—don’t overlook it!

To sum it up…Waiting for rates to plummet could mean missing out on great opportunities. Instead of sitting on the sidelines, let’s explore your options together.

📲 Call the Marty Rodriguez Team at (626) 914-6637 to discuss which strategy works best for you.

Market at a Glance

Glendora, CA - February 2025 Housing Market Update. Here's a quick snapshot of the current market trends:

Wondering how these changes impact your real estate goals? Reach out today to get personalized advice and make your next move with confidence! 📲

Be sure to check out our podcast, Real Talk with Marty, to learn more about real estate, investments, and the current market in Southern California.

*THIS IS AN OPINION ARTICLE, THAT SPECULATES ON FUTURE MARKETS. USE OR RELIANCE OF ANY OPINIONS CONTAINED ON THIS ARTICLE ARE AT YOUR OWN RISK.